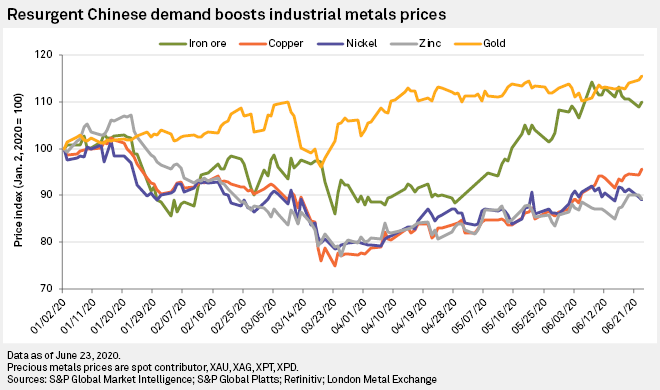

Metals prices continued to rally in May and June, spurred by a rebound in Chinese demand and lockdown measures easing in the U.S. and Europe, as major economies began reactivating. Iron ore was the standout performer, trading at 10-month highs above US$100 per tonne through June. Bullish sentiment also helped to drive base metals prices higher, although upward momentum was tempered by recent news of a fresh outbreak of coronavirus infections in Beijing. Concerns over a pandemic second wave and the global recession have elevated gold prices to their highest level since 2012, yet also pose the biggest threat to industrial metals prices.

We expect the reactivation of economies in the U.S. and Europe to lift industrial metals demand from current lows in the second half of 2020. The rebound in China, however, is pivotal to a sustained recovery in prices. The recent 6.1 trillion yuan Chinese stimulus announcement targeting infrastructure investment will help mitigate the harsh realities of a deep global recession and ongoing contraction in international trade.

We are more bullish on the prospects for copper and nickel prices over iron ore and zinc prices in the second half. The seasonal slowdown in Chinese steel production is expected to moderate iron ore prices over the summer, although the underlying tightness in the market will limit the downside. Chinese stimulus is expected to benefit copper demand and prices most of all. We anticipate excess supply to weigh on the zinc price recovery in the second half, while nickel is expected to ride the current wave of positive investor sentiment into the third quarter. The coronavirus second wave remains a key downside risk and will temper the upside for industrial metals prices in the second half, but it will help to keep gold prices at multiyear highs.

Iron ore – Prices surge to 10-month high

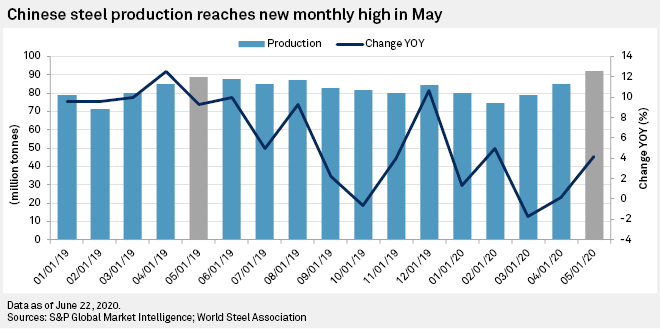

June saw iron ore prices climb and stay above US$100/t for the first time since August 2019, rising from US$84/t at the end of April. The rally was triggered by a China-centric restocking boom as steel production expanded to meet pent-up demand. Chinese steel production reached an all-time monthly record 92.3 million tonnes in May, advancing 8.5% month over month. Brazilian iron ore *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(6)>*:nth-child(1)” data-ae_domsib=”1″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

05/27/2020

Iron Ore CBS May 2020 — Full report’>supply concerns fueled restocking as Chinese mills sought a buffer against potential supply disruptions, following a surge in coronavirus infections. China’s growing appetite for imported iron ore saw January-May shipments rise 5.1% year over year.

Despite iron ore’s strong performance, we expect prices to ease back over the summer as a seasonal slowdown in Chinese steel output tempers demand. Recent news that Vale aims to *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(7)>*:nth-child(1)” data-ae_domsib=”1″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

06/18/2020

Vale to resume work at Itabira; Albemarle, SQM to reduce staffing amid COVID-19′>resume productionfrom its *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(7)>*:nth-child(2)” data-ae_domsib=”2″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

Itabira’>Itabira complex is also expected to weigh on sentiment. Despite this, we forecast Brazilian exports to contract 4.4% this year. Coupled with a healthy advance in Chinese imports, iron ore prices are expected to strengthen in the final quarter, buoyed by prospect of a global economic recovery in 2021.

Copper – Chinese stimulus to boost copper-intensive end-use

*:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(10)>*:nth-child(1)” data-ae_domsib=”1″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

05/11/2020

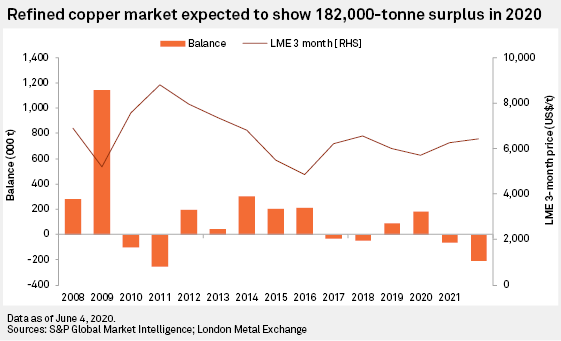

COVID-19 impacts to metals prices — The end of the beginning’>Since our May 11 article on the impacts of COVID-19 on metals prices, when London Metal Exchange copper was trading at US$5,224/t, prices have climbed 11% to US$5,784/t as of June 18. Late May saw investor positions on the LME equate to a net long position of 13,808 tonnes. The bullish sentiment was fueled by the healthy ramp-up in Chinese economic activity over recent months and the accompanying stimulus, which we expect to benefit copper-intensive end-use sectors. We have, therefore, upgraded our 2020 forecast for global refined copper demand to 23.47 Mt, although this still marks a 2.4% fall year over year.

First-quarter refined production results by major producers outperformed expectations. As a result, we have increased our global forecast for 2020 by 145,000 tonnes to 23.65 Mt, just 2% lower year over year. Alongside our forecast reduction in copper demand, this will drive the market into a major surplus in 2020. With China recovering ahead of the rest of the world, we forecast copper prices to climb to US$6,000/t by October. Resurgent demand is expected to see the copper market *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(11)>*:nth-child(1)” data-ae_domsib=”1″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

06/08/2020

Copper CBS June 2020 — Full report’>transition into deficit in 2021, driving up prices by almost 10% amid a global economic recovery.

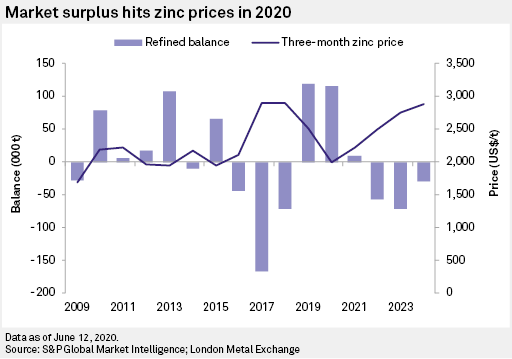

Zinc – Market surplus dents 2020 price outlook

Zinc prices have responded positively to the Chinese stimulus moves and have averaged US$2,016/t in June to date, up from US$1,975/t in May. The China-led recovery thus far has prompted us to revise Chinese zinc consumption upward. It is now expected to fall by only 2% year over year in 2020. Like copper, Chinese refined zinc output has also surprised on the upside, with May production 9.7% higher year over year. Better-than-expected results for major integrated refiners, including *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(14)>*:nth-child(1)” data-ae_domsib=”1″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

Teck Resources Ltd. (TECK.B)’>Teck Resources Ltd. and *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(14)>*:nth-child(2)” data-ae_domsib=”2″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

Hudbay Minerals Inc. (HBM)’>Hudbay Minerals Inc., was also coupled with bullish supply performances from miners, led by *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(14)>*:nth-child(3)” data-ae_domsib=”3″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

Glencore Plc (GLEN)’>Glencore PLC 13% year-over-year rise in production of mined zinc.

Buoyed by the recovery in China, zinc prices are expected to head cautiously higher over the near term before the market surplus weighs on prices deeper into the second half. We forecast a global refined *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(15)>*:nth-child(1)” data-ae_domsib=”1″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

06/12/2020

Zinc CBS June 2020 — Full report’>zinc surplus of 115,000 tonnes in 2020. This is expected to feed through to a 20% reduction in the average annual zinc price in 2020 to US$2,000/t.

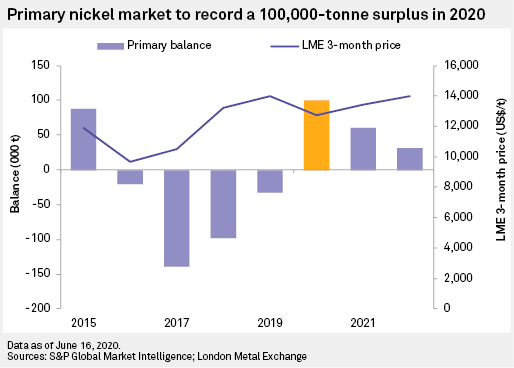

Nickel – Bullish investor sentiment despite weak fundamentals

Investor sentiment turned more positive for nickel. The LME Commitment of Traders Report indicates that investment funds’ net short position June 12 was its lowest level this year. Nickel prices subsequently moved within reach of US$13,000/t as of June 18 and are up 9% on May.

The bullish sentiment among investors, however, contrasts with *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(19)>*:nth-child(1)” data-ae_domsib=”1″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

06/18/2020

Nickel CBS June 2020 — Full report’>bearish nickel market fundamentals. The economic fallout from COVID-19 has triggered deep cuts in global stainless steel output, which we expect will lead through to an 8.5% contraction in global primary nickel demand this year. The Chinese stimulus, which is infrastructure focused, will not have a game-changing effect on nickel demand, with an 8% reduction expected in China in 2020. Battery-sector nickel demand is also expected to weaken this year, dented by the slump in global automotive sales.

Demand is expected to contract faster than supply, with global primary nickel production forecast to fall by just 3% in 2020. Indonesia’s ferronickel and nickel pig iron exports have surged year-to-date, reaffirming the Indonesian government’s decision to maintain its nickel ore export ban. With a gradual improvement in demand expected, we forecast prices to move up from June-quarter lows to average US$12,959/t in the second half. We still, nevertheless, forecast the global primary nickel market to move into a surplus this year.

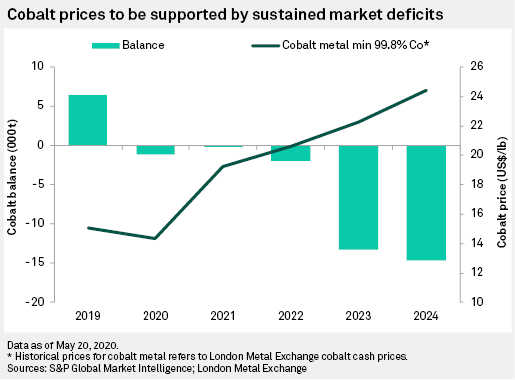

Lithium and cobalt – Automotive downturn weighs on prices

We have seen an acute downturn in the automotive sector, as lockdown measures and economic uncertainty have fed through to a slump in global vehicle sales. Electric vehicle sales have also suffered. China is expected to be the largest contributor to the global sales decline, due to the lower *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(23)>*:nth-child(1)” data-ae_domsib=”1″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

06/04/2020

Lithium and Cobalt CBS June 2020 — Full report’>penetration rates seen since subsidies were reduced by around 50% in July 2019. In contrast, we expect the European market to see modest growth this year as automakers attempt to sell more plug-in vehicles through an expanded range of models, to comply with the European Union’s tighter fleet vehicle emissions standards. We, therefore, expect a reduction in global demand for lithium and cobalt of 4% to 5% in 2020.

Diverging supply dynamics for lithium and cobalt have also weighed on our price outlooks. With the lithium market still in a major surplus, prices are forecast to slump by 30% in 2020 and to remain subdued into 2021, with supply expanding faster than demand. Oversupply is expected to remain a theme of the lithium market over the next few years, with a strong project pipeline.

It is a more consolidated supply picture for cobalt, however. We forecast cobalt prices to fall by 4.6% year over year in 2020, with the downside mitigated by a reduction in mine output — notably from Glencore’s *:nth-child(6)>*:nth-child(5)>*:nth-child(4)>*:nth-child(1)>*:nth-child(25)>*:nth-child(1)” data-ae_domsib=”1″ data-toggle=”tooltip” data-original-title=”" data-template=’

‘ data-container=”body” data-html=”true” data-trigger=”manual” data-offset=”10%” title1=’

Mutanda’>Mutanda mine, which accounts for 20% of global supply — and COVID-19 disruptions to refinery output. As a consequence, we expect the cobalt market to remain broadly in balance in 2020 in and 2021, when prices are then forecast to rebound sharply in anticipation of a growing market deficit.

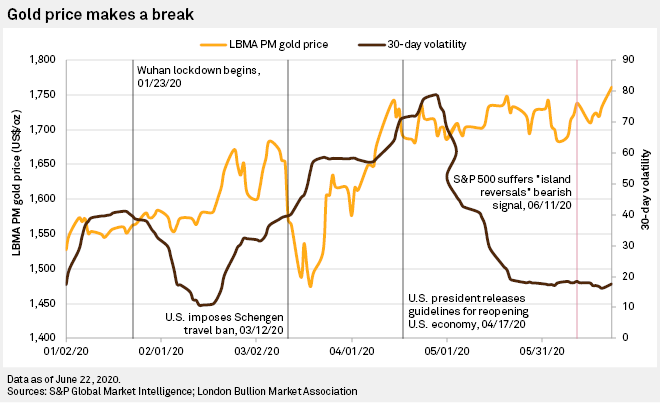

Gold – Uncertain outlook drives prices to 7-year high

Gold prices rallied strongly in April, as the global pandemic severely impacted the major economies of Europe and the U.S. The upside was tempered in May by a strong rally in equity markets stoked with optimism for an economic recovery, as lockdown measures began easing in Europe and the U.S. With global stock markets again pulling back in June, investors are viewing gold as a safe haven amid an uncertain economic outlook.

Climbing to a seven-year high, London Bullion Market Association PM gold prices reached US$1,765 per ounce June 22. Gold’s upward momentum has been spurred by the Federal Reserve commitment to low interest rates and quantitative easing bond purchases in June, while global stock markets weigh concerns over a second wave of COVID-19. With investors showing a renewed appetite for gold in June, we expect prices to rise above US$1,800/oz in the near term.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Post time: Jul-31-2020